Description

Introduction

Risk Management in Mergers &Acquisitions(M&A) transactions involve significant financial, legal, operational, and strategic risks that can impact deal success. Effective risk management is critical to identifying, assessing, and mitigating potential threats throughout the M&A lifecycle. This Risk Management in Mergers &Acquisitions training provides a structured approach to understanding key risks in M&A, developing risk mitigation strategies, and ensuring value creation and deal sustainability.

Prerequisites of M&A

- Basic knowledge of corporate finance and M&A fundamentals

- Familiarity with due diligence and risk assessment processes

- Understanding of legal and regulatory compliance in business transactions

Table of Contents

1. Overview of Risk Management in M&A

- 1.1 Why Risk Management is Critical in M&A

- 1.2 Common Risks in M&A Transactions

- 1.3 Risk Assessment Frameworks

2. Financial Risks in M&A

- 2.1 Overvaluation and Overpayment Risks

- 2.2 Impact of Debt Financing and Leverage

- 2.3 Foreign Exchange and Currency Risks

3. Legal and Regulatory Risks

- 3.1 Antitrust and Competition Law Considerations

- 3.2 Compliance with International Regulations

- 3.3 Intellectual Property (IP) and Contractual Risks

4. Operational and Integration Risks

- 4.1 Post-Merger Integration Challenges

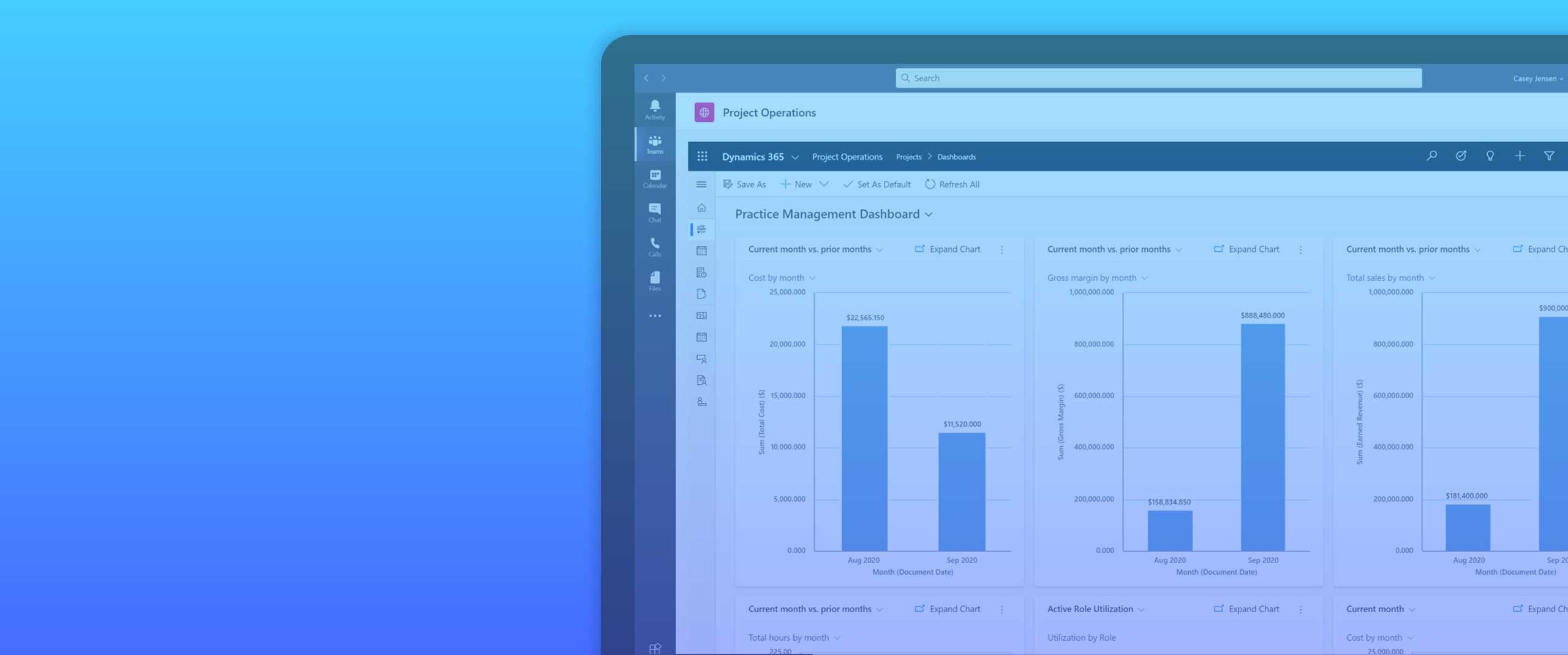

- 4.2 IT and System Integration Risks

- 4.3 Supply Chain and Vendor Dependencies

5. Cultural and Human Capital Risks

- 5.1 Leadership and Talent Retention Challenges

- 5.2 Organizational Culture Clashes

- 5.3 Employee Resistance and Change Management

6. Due Diligence for Risk Identification

- 6.1 Financial Due Diligence: Identifying Red Flags

- 6.2 Legal and Compliance Due Diligence

- 6.3 Environmental, Social, and Governance (ESG) Risks

7. Strategic Risks in M&A Deals

- 7.1 Aligning Business Goals and Growth Strategies

- 7.2 Market Entry and Competitive Positioning Risks

- 7.3 Synergy Realization and Performance Risks

8. Risk Mitigation Strategies

- 8.1 Structuring Risk-Aware Deal Agreements

- 8.2 Insurance Solutions for M&A Transactions(Ref: Cross-Border Mergers & Acquisitions(M&A): Challenges and Opportunities)

- 8.3 Contingency Planning and Crisis Management

9. Case Studies: Successes and Failures in M&A Risk Management

- 9.1 Major M&A Failures Due to Poor Risk Management

- 9.2 Best Practices from Successful M&A Deals

- 9.3 Interactive Workshop: Identifying and Managing M&A Risks

Risk Management in Mergers &Acquisitions is a critical success factor that ensures smooth transactions and post-merger integration. This Risk Management in Mergers &Acquisitions training equips professionals with risk identification, assessment, and mitigation strategies to minimize uncertainties and maximize deal value and long-term success.

Reviews

There are no reviews yet.